Download for free today

Toward a new understanding of financial literacy

As new financial pressures and realities converge with an explosion of new financial tools, trends, and instant access to an abundance of information, how is the way people are thinking about and managing their money evolving – and what does this mean for the insurance industry?

What does it take to be financially literate today?

With the personal finance landscape rapidly evolving and economic realities shifting, our new report explores what it takes to be financially literate in today's changing world and how insurance companies can support customers in their journeys toward financial freedom. The report explores:

Findings from a cross-generational survey of Americans about their personal finances

We spoke with over a thousand Americans from across the U.S about their personal finance habits, beliefs and mindsets to uncover findings that at once complicate and elucidate what it means to be financially literate today.

A new model for thinking about financial literacy

Using insights from our survey, we offer a model for how financial literacy exists within a spectrum of confidence and financial freedom, surfacing key personas that exist along this continuum.

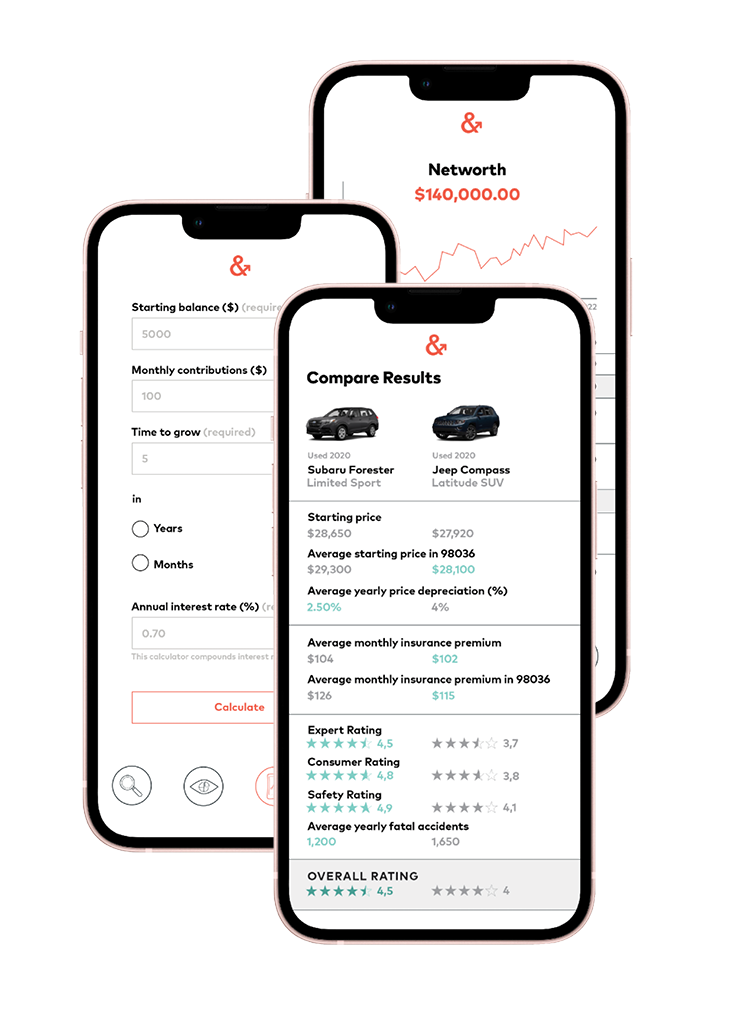

Opportunities for insurers to support customers in their journeys toward financial freedom

Based on our continuum of financial literacy, we identify three opportunities for how insurance companies can help their customers drive toward financial literacy and ultimately achieve financial freedom.

What people are saying

I always take the time to read Cake & Arrow's research – it’s very impressive and never fails to offer a unique perspective on the industry.

- Jessie, SVP, Global Insurance Carrier

Subscribe to our monthly newsletter

The Slice, Cake & Arrow's monthly newsletter, delivers smart takes and trends from the intersection of UX and insurance fresh to your inbox.